Investors who are interested in opening companies in the Isle of Man can receive specialized assistance from our team of local incorporation experts.

Some of the top advantages that bring investors to the Isle of Man are the following:

- Easy incorporation: offshore Isle of Man company registration is simple and fast (as highlighted below).

- Low taxation: there is a zero corporate income tax for many types of activities; an important advantage for many investors who wish to also be closely located to the UK or the rest of Europe.

- Infrastructure: the Isle of Man may be small, however, it offers great connectivity and has good power and telecom infrastructure.

- Business environment: the Isle of Man welcomes foreign investors and has maintained a successful business and investment space by making its laws simple and efficient.

In addition to these advantages, which are primarily the focus of entrepreneurs, the Isle of Man also offers good living conditions, with low crime rates and low personal income taxes.

| Quick Facts | |

|---|---|

| Please introduce the types of companies that can be started by foreigners | 1931 Act Companies – Public and Private, 2006 Act Companies |

|

Minimum share capital for LTD Company (if applicable) and Paid-In Requirement (YES/NO) |

No |

|

Minimum number of shareholders for Limited Company |

1 in most cases (two are required for some types of public companies) |

| Time frame for the incorporation (approx.) | 48 hours standard time (following the complete submission of the registration documents) |

| Corporate tax rate |

0% in general and 10% or 20% for certain types of activities |

| Dividend tax rate |

0% |

| VAT Rate |

20% standard rate, reduced rates of 5% and 0% for certain types of goods and services. |

| Number of Double Taxation Treaties (approx.) |

10 |

| Do you supply a Registered Address? (YES/NO) |

Yes |

| Local Director Required (Yes/No) | No |

| Annual Meeting Required |

Not necessarily; applicable in the case of 1931 Act Companies. |

| Redomiciliation Permitted |

Yes |

| Electronic Signature |

Yes, under the alternative method of signing documents as per the 2020 Regulations (may be subject to change). |

| Is Accounting/Annual Return Required? |

No filing of financial statements, however, companies file the annual return with the Registry. |

| Foreign-Ownership Allowed | Yes |

| Are any Tax Exemptions Available? (Offshore Income, Dividend Income etc.) | Dividends are generally subject to an exemption and taxed at 0%. |

| Any Tax incentives (if applicable) | Government grants and employee concessions are in place for new businesses (subject to conditions). A land development tax holiday scheme is available. |

| Beneficial ownership | Regulated through the Beneficial Ownership Act 2021; disclosure requirements are in place. |

| Residency requirements for company founders | They do not need to be Isle of Man residents. |

| Investor restrictions according to nationality | None |

| Alternative minimum tax | Not applicable. |

| Capital gains tax | Not subject to taxation. |

| VAT registration | Mandatory for companies that exceed GBP 85,000 per year in taxable supplies. Voluntary registration also applies. |

| Payroll tax | Not imposed in the Isle of Man. |

| Licensing requirement | Some types of activities are regulated under the Financial Services Act and businesses are licensed by the Financial Services Authority. |

| Types of activities that are licensed | Class 4 and Class 5 regulated activities, issued to fiduciary businesses. |

| Special conditions for licensing | The financial services licence holder must meet several criteria, including the one for being fit and proper. |

| Overseas companies | Must register with the Isle of Man register as a foreign company under the 1931 Companies Act. |

| Company closure | Voluntary or court closure (in some cases). |

| Distance incorporation (when the investor is not in the IoM) | Our team can act as representative, through a power of attorney, for the duration of the incorporation and/or as otherwise agreed for other matters. |

| Offshore company formation services (Yes/No) | Yes |

| Reasons to incorporate in the Isle of Man | Straightforward incorporation, zero tax (for many types of activities), conveniently located to the UK and Europe. |

| How we can help you | We offer complete services throughout the company registration phase, and after the business is registered, as investors may find that they have questions about doing business in the IoM. |

| When to contact our team | As soon as you decide to incorporate one of the available business forms or as needed for information about the business climate and investment conditions. |

The Isle of Man is a small island located in the Irish Sea which gives foreign investors access to an independent territory which follows the laws and regulations of Great Britain. With strong connections with the UK, the Isle of Man, also known as Mann, offers a great investment environment in industries such as finance, insurance, and online gaming. Also, the Isle of Man is the 5th richest territory in the world based on its Gross Domestic Product per capita, according to the World Bank.

Foreign investors who want to open companies can choose between various structures, that are presented by our Isle of Man company formation agents below.

Types of companies available in the Isle of Man

Investors who are interested in setting up a company in the Isle of Man can choose between the limited liability company and the partnership, according to the Companies Act. However, there are other laws that provide for trusts and foundations which represent important tax planning tools in the Isle of Man.

One of the most sought types of companies in the Isle of Man is the offshore company which is suitable for various activities and offers many advantages. Offshore companies are governed by the International Business Act of 1994.

Investors can register their chosen type of company themselves or talk to one of our agents who provide corporate incorporation services.

There are three types of company incorporation, differentiated by the time it needs to complete the registration:

- the standard incorporation: takes place within 48 hours and will include a fee of 100 £.

- the two-hour incorporation: possible when the documents for registration are submitted before 2:30 pm during a business day.

- the fast-track incorporation: can take place while the applicants wait for the service to be completed and will cost more than the previous types; this very fast incorporation is possible when all of the documents are received before 4 pm on a business day.

The very fast incorporation procedure is an important advantage for investors. However, entrepreneurs must keep in mind that this is only possible when the applicant has paid the fees and has chosen a unique company name. Otherwise, the process will be longer when some of the steps need to be re-made.

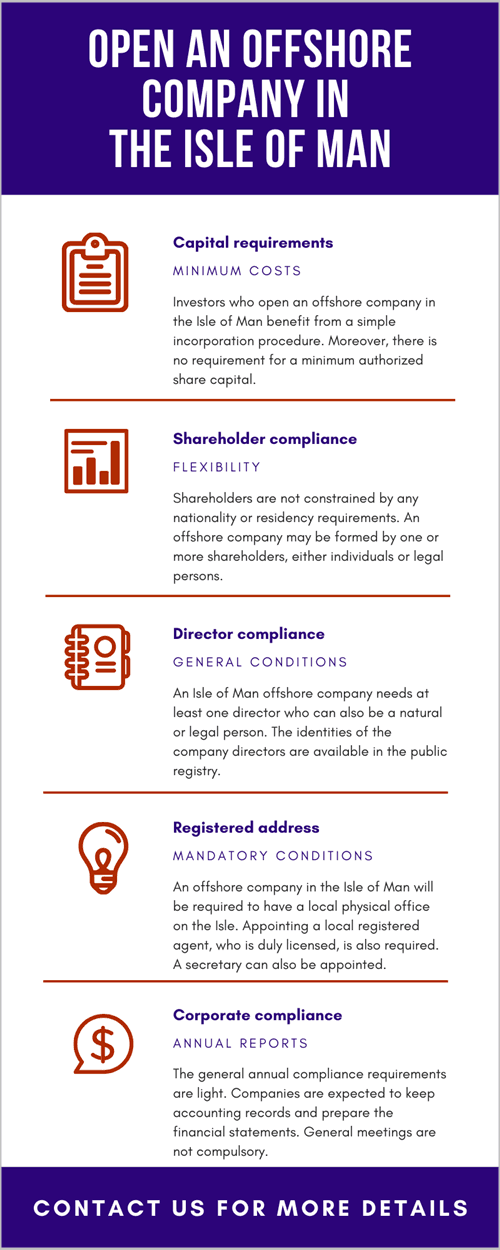

Requirements to open an offshore company in the Isle of Man

The formation of an offshore in the Isle of Man implies the registration of a limited liability company. The following conditions must be fulfilled in order to open an offshore company in Isle of Man:

- choosing a company name which must end in Limited, Ltd., Public Limited Company, PLC.;

- appointing a company director, who must not necessarily be a resident;

- preparing the documents for incorporation;

- having a legal address in Isle of Man;

- open a bank account in the Isle of Man.

Even if the offshore company is registered in the Isle of Man, its activities cannot be undertaken here. Our local advisors can assist businessmen who want to open non-resident Isle of Man bank accounts.

The company must file an annual return regardless or not the company has recorded trading activities over the past year. The fees for annual return filings vary according to the type of company, are less for standard companies and higher for companies that are registered as charities. Penalties apply for failure to file this return and actions may be taken upon the company officers. In some situations, the company can be unregistered.

The company details can be changed after the Isle of Man company registration process, by filling in the appropriate forms. The registered office and the details of the directors and secretary can be changed (when they are appointed or resign). Certain fees apply for these changes and they are higher if more than three months pass between the time the date occurs and the date at which the change is registered.

As far as company management is concerned, investors in the Isle of Man can appoint a nominated officer or a nominee director/shareholder. This is done in order to increase the level of confidentiality for the company’s beneficial owner, the shareholder who actually owns shares and receives the dividends. A condition to appoint a nominated officer is for he to be an Isle of Man resident. The officer will be the one to hold the relevant information on the beneficial owners. One of our Isle of Man company formation agents can give you more details about the requirements for appointing a nominee shareholder.

The following video presented by our agents summarizes the advantages of opening an offshore company in the Isle of Man:

Making changes to existing businesses in the Isle of Man

Investors who open or purchase a company in the Isle of Man are expected to follow through with the registration requirements but will also need to pay attention to any other subsequent changes, as they may occur during the life of the company.

Any change in the company details or the business in which it is engaged in will be noticed to the authorities. This is a step during which our team of Isle of Man company formation agents is ready to help. Foreign investors who need assistance for these mandatory steps, and who cannot be present in the country when the due date for reporting the change takes place, can reach out to our agents for complete assistance and representation. Below, we list some of the situations in which companies in the Isle of Man are required to report changes:

- the company officer is changed: this can be a new director or a secretary; nevertheless, whenever one of the company officers changes, this is to be reported through a special Form N.

- the registered office changes: having a registered office on the island is mandatory for resident companies; if this address changes, the company officers need to notify this change within one month.

- capital or share increases and changes: when the company’s capital is increased, as well as when new shares are issued, the company officers need to notify these changes.

Penalties apply for the late filing of the forms that are used to notify these three types of changes. In general, the penalties are included in two categories (for delays of one month and one day to three months – this is the lower amount and for more than three months – with double the penalty value). One of our agents can provide detailed information about the penalties and their value.

Any changes to the business name are also to be notified to the Companies Registry (and this must take place within 14 days of such change). Late notice fees also apply for name change notifications although they are substantially lower than for the other types of late notifications.

When the company ceases trading, the Registry is to be notified within three months of the termination of activities by means of a special form.

All of the changes that need to be notified are especially relevant in case of purchasing a shelf company. One of our Isle of Man company registration specialists can provide more details.

Annual declarations in the Isle of Man and other requirements

Companies in the Isle of Man with a registered business name must fulfill a set of requirements. Among these we can mention the annual declaration (or form ADB) which states that the business will continue to trade and does not change any particulars. The deadline for filing this statement is on the anniversary of the name registration (each year, without any fee). As previously mentioned above, companies that do change their particulars will need to file different forms. The types of changes in particulars that are available for registration are by an individual, by a partnership or by a corporate body (there is a separate form for each of these three possibilities). The declaration is filed with the Companies Registry.

Apart from the declaration that signals that there have been no changes throughout the year, another annual return is to be filed by company owners in the Isle of Man. This reflects the situation of the company on its registration anniversary date (which is also the date on which the declaration is to be filed).

Investors who are interested in offshore company formation in the Isle of Man should know that compliance with this annual return is mandatory and failure to do so may result in the prosecution of the company officers or, as an alternative measure, the company being struck off the register. There are three different forms for the annual returns, depending on the type of company: for a 1931 Act company, for a 2006 Act company or for a foreign company. One of our agents can provide more details about the information that needs to be included in these forms.

Annual return fees apply when submitting the declarations and they have varying amounts, depending on the type of legal entity (for standard companies, exempted companies or charities). The standard fee applies when the declaration is filed on time and two larger fees apply for late filing (after 1 month and 1 day to three months and the largest value for filing more than 3 months after the due date). The submitted documents are checked for accuracy as well as consistency.

By working with out team of company formation experts and our CPA in the Isle of Man, foreign investors will make sure that they are fully compliant with the current regulations. Our accountant will help you meet the accounting requirements, as well as prepare the annual financial statements for the company in a true and fair view, according to the International Financial Reporting Standards.

Uses of an offshore company in the Isle of Man

Foreign investors who are interested in Isle of Man company formation must know that these entities are usually used for one of the following purposes:

- for trading activities with companies in EU countries;

- for investment purposes;

- for holding purposes.

Our Isle of Man company registration agents can offer information on the uses of offshore companies.

Companies that are incorporated for specific purposes, such as insurance, mutual funds or others in the financial sector, are under the supervision and control of the Isle of Man Financial Services Authority. The Financial Services Act 2008, the Insurance Act 2008 and the Collective Investment Schemes Act 2008 are all important legal resources for investors interested in starting a business in the financial sector.

Those who wish to engage in gambling and e-gaming activities in the Isle are also required to comply with specific regulations, as set forth by the Gambling Supervision Commission. Gambling activities have seen substantial growth in recent years in the Isle of Man and businesses are required to comply with the licensing requirements as well as keeping the industry crime-free.

Reasons to open an offshore company in the Isle of Man

As seen from this article, offshore company formation in the Isle of Man is simple and quick and investors have many benefits when choosing to open their business here.

The Isle of Man offshore company offers many advantages, among which we mention the following:

- no taxes on certain activities;

- the accounts of an offshore are not subject to audits;

- no local director must be appointed;

- no annual shareholders’ meeting must be held;

- companies will have VAT numbers accepted in the EU.

These features are often important for investors and they are the main reasons why foreign entrepreneurs choose to establish their company here. From the Isle of Man, they can easily access surrounding markets and even other European countries of interest, all while operating under favorable conditions and favorable business legislation.

Apart from the incorporation advantages and the lack of taxes, investors who are interested in Isle of Man company registration can also benefit from enterprise support from the Government. Below, we list some of the basic schemes:

- Microbusiness grant scheme: for all business sectors, for first-time investors; companies operating for less than 18 months with an annual turnover of 5,000-100,000 £.

- Business improvement scheme: for existing and new businesses that offer consultancy and mentorship in areas like marketing, social media, business advisory services, environmental efficiency, and others.

- Vocational training assistance scheme: for businesses that have a registered office in the Isle of Man and provide direct employment here.

- The town and village regeneration scheme: for businesses within regeneration zones, with properties in such special areas, with the property being destined for commercial use and open to the public.

- Business energy saving scheme: for companies in all business fields that have projects which increase energy efficiency.

- Investors in People: for businesses that focus on their people and have a minimum of two employees and no government debts.

- Enterprise development scheme: for companies engaged primarily in export-focused activities, in certain sectors; suitable for start-ups and companies that wish to expand or those that relocate to the Isle of Man.

These are just part of the business support schemes that are available to companies. Investors who are interested in knowing more can reach out to our agents who specialize in Isle of Man company registration in order to find out more (details about targeted sectors, eligibility criteria and how to apply). The main authority to contact in regards to these types of enterprise support schemes is the Department for Enterprise. Some of these schemes do not apply retrospectively.

Below, we present a set of relevant figures that reflect the situation in the Isle of Man:

- GDP 2016/2017: 4.88 billion £;

- total employment in December 2018: 35,256 in 52,350 jobs;

- the funds under management in the Isle of Man in December 2018 amounted to 17.9 billion US$;

- the total number of insurers in the Isle of Man in 2018 was 116;

- in 2018, 762 new companies were registered under the 1931 Act and 985 companies were registered under the 2006 Act.

For assistance in registering an offshore company in the Isle of Man, please contact us. You can also ask our Isle of Man company formation specialists on the other advantages offered by offshore companies.